2013 4th Quarter Commentary

Investing in the Stock Market

While Sleeping Well at Night

The first thing we learn as Financial Planners is that no one can predict the future when it comes to the stock market. The best we can do is build diversified asset allocation portfolios, which allow us to participate in the markets while giving us some margin of protection on the downside.

So how should we invest when the U.S. Stock Market is high? It may help to take a look at the history of the Dow Jones Industrial Average (DJIA) market declines. Over the last 100 years, the DJIA has averaged:

– a 10% decline approximately once per year,

– a 15% decline about once every two years, and

– a 20% decline approximately every four years.

Currently, the DJIA has not had a 10% correction since the third quarter of 2011. It is important to remember a healthy market correction does not have to be a disaster. In fact, the indexes often climb to higher levels after a correction.

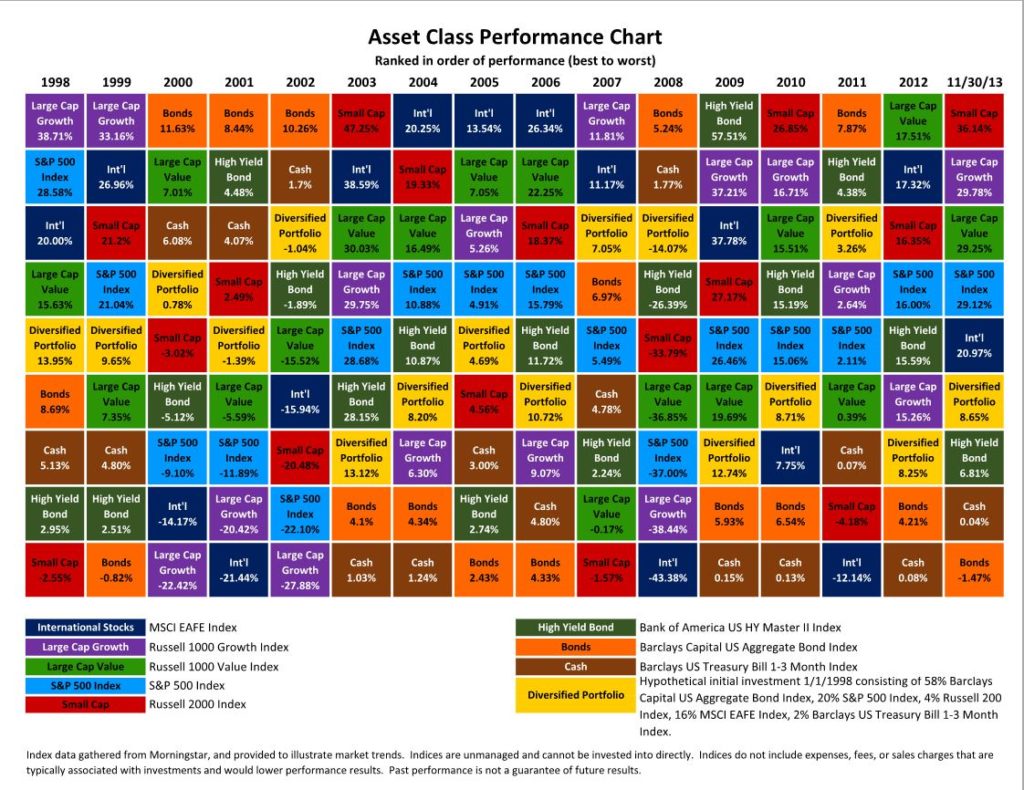

Once again we have included an Asset Class Performance Chart (see below) with our Quarterly Commentary. Please note that in 1998 and 1999 U.S. Large Cap Growth Stocks (printed in purple) ranked the highest of all asset classes. However, in 2000, 2001, and 2002, it ranked at or near the very bottom. By 2007, the U.S. Large Cap Growth Stocks category was again ranked the highest. Note that in 2008, it ranked near the bottom. As we begin 2014, U.S. Large Cap Growth Stocks once again stand at all-time highs. In times when this is happening, it is very tempting to abandon our well thought out asset allocation strategies and chase the highs.

Returning once again to the Asset Class Performance Chart, it is important to note how the Diversified Portfolio (printed in bright yellow) did over the same time period. It seems boring in comparison to the Large Cap Stocks, but it does offer us the opportunity to participate in the markets while sleeping well at night. Now more than ever, we believe it is important to be disciplined and stick to our asset allocation strategies.

The views expressed are not necessarily the opinion of Cambridge Investment Research, and should not be construed directly or indirectly, as an offer to buy or sell any securities mentioned herein. Investing is subject to risks including loss of principal invested. No strategy can assure a profit nor protect against loss. Past performance is no guarantee of future results. Indexes are unmanaged and investors are not able to invest directly into any index. Sources for this information include Wilshire Compass, the Capital Research and Management Company, and Morningstar.

This material contains forward looking statements and projections. There are no guarantees that these results will be achieved.