2016 1st Quarter Commentary

WHAT IS GOING ON WITH THE U.S. STOCK MARKET?

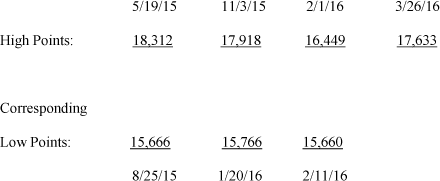

Since May of 2015 the U.S. Stock Market has experienced dramatic fluctuations. The Dow Jones Industrial Average, one of the primary indexes used to track the U.S. stock market, has literally bounced up and down like a yo-yo.

Point to Point Movements of the DJIA since May of 2015:

Although many things can affect the stock market, we feel that one of the primary reasons for the above phenomenon is the wide-spread regulatory uncertainty in the U.S. business and economic environment. Since the recession of 2008, there has been a tremendous proliferation of regulatory changes across multiple industries: energy production, automobile production, health care, banking, etc.

It isn’t just the regulations. U.S. industries have been dealing with regulation for years. It is the speed at which the regulations are being issued and the random timing of them. In order for companies to plan their business strategies, (which include expanding facilities, hiring, research, new products and services) they need to have regulatory stability.

As a consequence, the S&P 500 Companies currently hold $1.44 trillion in cash. This is an unprecedented situation. When asked why so much is being held in Cash instead of investing to expand their businesses, many CFO’s (Chief Financial Officers) respond by saying, “a fear of the unknown”.

The best way to understand the relationship of the regulatory uncertainty to the volatile stock market is to think of the Stock Market as a “horse” and the U.S. Economy as a “cart”. The stock market “horse” sees U.S. companies loaded with cash so it wants to run. The economic “cart” is stuck in the mud of regulatory uncertainty and can’t move. Ultimately, the stock market tends to go the direction of the economy. Consequently, if the “horse” gets too far ahead of the “cart”, it will simply correct and pull back to a reasonable level matching the economy.

The good news is that the S&P 500 Companies are loaded with cash! Ultimately, when the regulatory environment begins to stabilize, that money should find its way back into U.S. businesses. When that happens the real, underlying economy should begin to grow again, (i.e. the “cart” will start to get traction). That is why we believe there is every reason to be optimistic about the long term rewards of participating in the U.S. market.

Sources: factset.com, CFO.com and the Wall Street Journal.

These are the opinions of Financial Professionals, Inc. and not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.